Please note that ISDA no longer supports the 2006 ISDA Definitions – see ISDA’s statement for further information.

This page will be updated on a regular basis as relevant information becomes available and will serve as a repository for information from ISDA relating to the 2021 Interest Rate Derivatives Definitions.

This page is divided into five sections:

- Background

- Accessing the 2021 Definitions on the MyLibrary Platform

- General Educational Materials

- Implementation

- Working Group Participation

- Introduction to Implementation of the 2021 ISDA Interest Rate Definitions

- Key Changes in the 2021 Definitions

- Floating Rate Options

- Confirmations

- Cash Settlement Methods

- Clearinghouse Presentations on Implementing the 2021 Definitions

- Trading Venues

- Middleware

- Implementation Interviews: Participant Recommendations

- Implementation Working Group Calls

- 2021 ISDA Interest Rate Derivatives Definitions Preferences Grids

- Versions of the 2021 Definitions

On June 11, 2021, ISDA published the first version of the 2021 ISDA Interest Rate Derivatives Definitions, following a root and branch review of the current market standard definitional booklet for the interest rate derivatives market – the 2006 ISDA Definitions.

The 2021 Definitions have retained much of what worked well under the 2006 Definitions, but in some areas have been substantively updated to better reflect modern market practices, improve clarity and to make transactions more robust in the face of contingencies such as market closures and benchmark related events. An article discussing the benefits of the new 2021 ISDA Interest Rate Derivatives Definitions is available here: IQ: ISDA Quarterly, February 2021 – Transformational Change. A Japanese translation of this article is available here.

Since the October 4, 2021 implementation date all major global CCPs have adapted their rulebooks to adopt the 2021 Definitions and adoption in the non-cleared market has reached key milestones (approximately 2/3rds of electronically confirmed non-cleared trades now reference the 2021 Definitions) and many major market participants have switched to the new definitions by default or upon request. ISDA anticipates rapid and widespread adoption in the rest of the non-cleared market. ISDA continues to work with its member working groups to identify and resolve issues relating to the adoption and implementation of the 2021 Definitions and to draft subsequent versions of the 2021 Definitions. Versions 2, 3, 4, 5, 6, 7, 8, 9, 10, and 11 of the 2021 Definitions were published on September 30, 2021, November 10, 2021, December 16, 2021, March 25, 2022, May 27, 2022, November 18, 2022, March 10, 2023, July 28, 2023, November 3, 2023, and April 26, 2024, respectively. Please note that ISDA no longer supports the 2006 ISDA Definitions – see ISDA’s statement for further information.

The 2021 Definitions also represent ISDA’s first natively digital definitional booklet, published exclusively on the ISDA MyLibrary platform. This enables users to view a consolidated version of the definitions, to see how they have changed over time and provides access to enhanced user facilities such as hyperlinking to definitions, bookmarking and additional resources. For more information on how to access the MyLibrary platform, please contact onlinelibrary@isda.org. A fact sheet on MyLibrary is available here. A webinar on the 2021 Definitions and MyLibrary can be seen here.

- Factsheet: Introduction to the 2021 ISDA Interest Rate Derivatives Definitions (April 19, 2021)

- Video: Introduction to the 2021 ISDA Interest Rate Derivatives Definitions (May 10, 2021)

- Letter from Scott O’Malia (ISDA CEO) to Buyside and End User Trade Associations re: Imperatives to Pro-Actively Adopt the 2021 ISDA Interest Rate Derivatives Definitions

- IQ: ISDA Quarterly, February 2021 – Transformational Change

- Press Release: ISDA Selects Kinetix and Linklaters to Develop Documentation User Platform (February 3, 2021)

- Letter from Scott O’Malia (ISDA CEO) to all users of derivatives (for use by participants in the derivatives market in their client outreach on the 2021 Definitions)

The ISDA 2021 Definitions Implementation Subgroup met on a weekly basis in the run up to October 4, 2021, to identify and resolve issues relating to the adoption and implementation of the 2021 Definitions. Issues related to adoption and implementation are now being discussed in the ISDA Rates Market Infrastructure Group. The group is open to ISDA members and, given its focus on operational implementation, tends to be attended by operations staff from member firms. If you are interested in participating in the ISDA Rates Market Infrastructure Group, please contact marketinfrastructureandtechnology@isda.org. Members of ISDA can access recordings of the Implementation Sub-group calls below.

- Key Changes in the 2021 ISDA Interest Rate Derivatives Definitions – Japanese edition (August 19, 2021)

- Key Changes in the 2021 ISDA Interest Rate Derivatives Definitions (June 24, 2021)

Note that reversioning of the mapping table is subject to the addition of Rate Options to the Floating Rate Matrix

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 1 (July 19, 2021)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 2 (September 30, 2021)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 3 (November 10, 2021)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 4 (December 16, 2021)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 5 (May 27, 2022)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 6 (November 18, 2022)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 7 (July 28, 2023)

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 8 (November 3, 2023)

- FpML FRO Naming Convention 2021

- Mapping Tables for FROs under the 2006 Definitions and FROs under the 2021 Definitions – Version 9 (April 26, 2024)

*based on version 1 of the 2021 ISDA Interest Rate Derivative Definitions

- Summary of Clearinghouse implementation plans

- LCH Presentation

- CME Presentation

- Eurex Presentation

- HKEX Presentation

- KRX Presentation

- ASX Presentation

- JSCC Presentation

- KDPW Presentation

- BME Presentation

- Trading Venue implementation plans (November 27, 2021)

- Summary of Trading Venue implementation plans (September 30, 2021)

- Summary of Middleware implementation plans from MarkitServ

- MarkitServ implementation—Nov. 4, 2021 ISDA Definitions Implementation Subgroup update

On behalf of ISDA, consultancy firm Quorsus conducted several interviews across a cross-section of ISDA members to ascertain the steps firms are taking, or have identified as necessary, to implement the 2021 Interest Rate Derivatives Definitions. The Quorsus report, Implementation Interviews: Participant Recommendations, highlights suggested operational practices identified during the interviews to help firms in their preparations.

| WG Call Recording & Title | Date of Call | Description |

| Focus on trading venues | May 27, 2021 | Discussion with major trading venues on proposed approaches for implementing 2021 Definitions. |

| Focus on clearing houses | June 3, 2021 | LCH, Eurex and CME present their plans for implementing the 2021 Definitions. |

| Focus on Asia clearing houses | June 24, 2021 | ASX, HKEX and KRX present their 2021 implementation plans. |

| CME presentation | June 30, 2021 | CME presents their updated 2021 implementation plans. |

| Focus on trading venues | July 15, 2021 | TP ICAP, Tradeweb and Bloomberg present their 2021 implementation plans. |

| MarkitSERV presentation | August 12, 2021 | MarkitSERV present their 2021 implementation plans. |

| MarkitWire Default and Trade Reporting | August 26, 2021 | Discussion of MarkitWire’s default for contractual definitions in the absence of express election and update from the Trade Reporting Working Group. |

| MarkitWire Default and Trade Reporting | September 2, 2021 | MarkitWire update and discussion on the default for contractual definitions in the absence of express |

| Presentation by MarkitWire and Trading Venue implementation updates | September 13, 2021 | MarkitWire revised default proposal and Trading Venue implementation plan updates from Bloomberg, TradeWeb and TPICAP |

| Presentation by MarkitWire on Cash Settlement – Elections in MarkitWire | September 16, 2021 | Reminder for High-level Implementation Survey submissions followed by a presentation from MarkitWire on Cash Settlement elections in MarkitWire. |

| Presentation by JSCC and update from HKEX | November 10, 2021 | Group discussion plus presentation by JSCC on their updates for implementing 2021 Definitions and updates from HKEX |

The phased approach to implementation of the 2021 Definitions means that some market participants will be ready to trade using the 2021 Definitions with their counter parties from October 4th while others will not be ready until a later date. In order to reduce the potential for breaks and in order to help facilitate a safe and efficient market, ISDA has agreed to post information regarding firms’ definitions preferences in a standardised format. ISDA takes no responsibility for the information any preference grid contains and makes no representation as to its accuracy or completeness. For a definitive understanding of a party’s definitional preferences, market participants should contact the relevant party. Contact details (to the extent they have been provided) can be found at the bottom of each preference grid. By accessing the information provided, users agree that they will not use the information for any anti-competitive purpose.

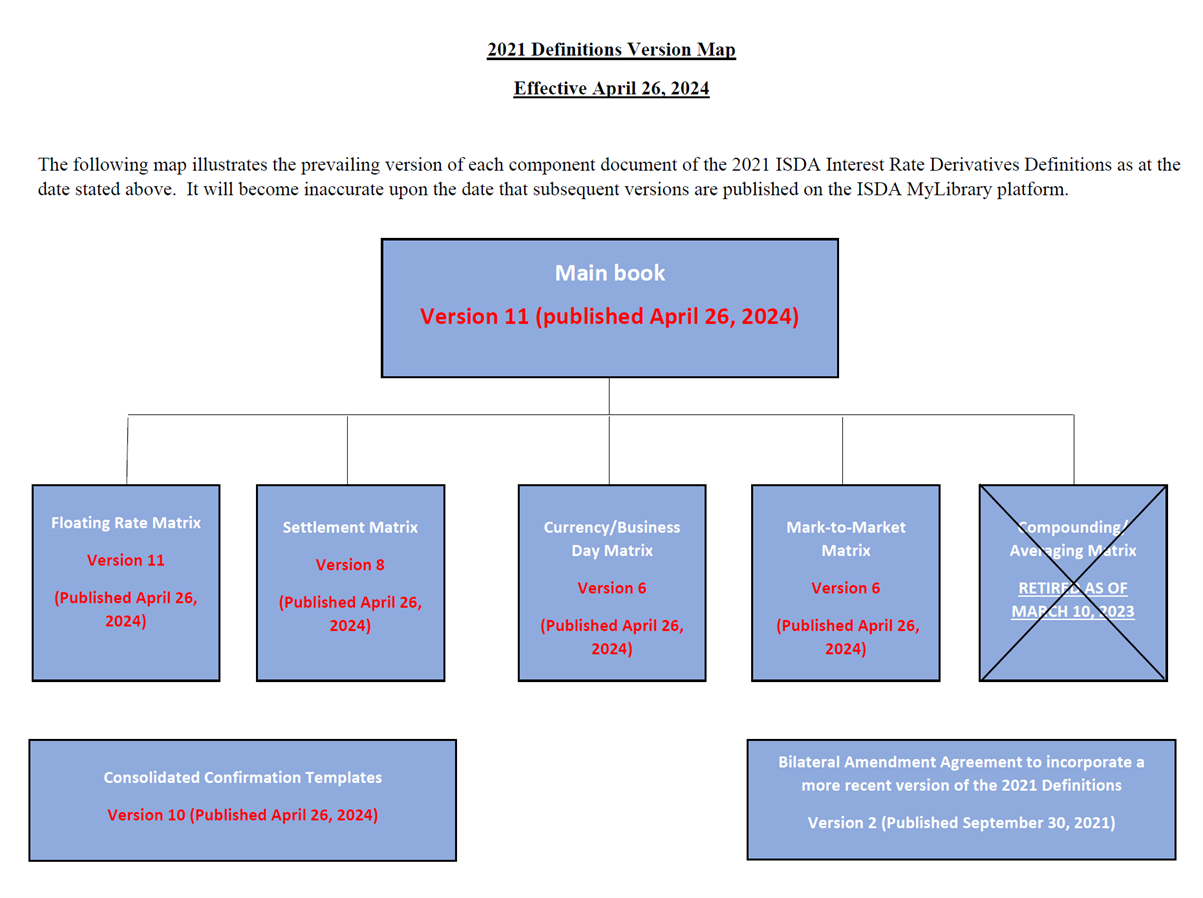

While the 2006 ISDA Definitions are amended by the publication of ‘Supplements’, component documents of the 2021 Definitions (such as the Main Book or Matrices) are amended and restated in their entirety in new versions. Versions of each component document are differentiated by number and date (eg, Main Book, Version 1, June 11, 2021 or Version 2, September 30, 2021). ISDA has also published confirmation templates for use with the 2021 Definitions.

ISDA has published the following releases of the 2021 Definitions:

- June 11, 2021

- September 30, 2021

- November 10, 2021

- December 16, 2021

- March 25, 2022

- May 27, 2022

- November 18, 2022

- March 10, 2023

- July 28, 2023

- November 3, 2023

- April 26, 2024

The following Version map illustrates the current versions of the component parts of the 2021 Definitions with effect from April 26, 2024.

If you are interested in participating in the working group producing versions of the 2021 Definitions, please log on to your ISDA account and join the Interest Rate Definitions Working Group.

|

WG Call Recording & Title

|

Date of Call | Description |

| General Overview | February 1, 2022 | Q1 Update to the 2021 ISDA Interest Rate Definitions (v5) and Quarterly Update Cycle |

|

WG Call Recording & Title

|

Date of Call | Description |

| General Overview | March 17, 2020 | The major aims of the project and a high level walk through of the consolidated draft booklet as it currently stands. |

| Calculation Agent / Dispute Resolution | March 31, 2020 | Changes to the Calculation Agent language and the new dispute resolution provision. |

| Dates/Periods | April 7, 2020 | Changes to terms relating to dates and periods, including Business Days, Payment Dates and Period End Dates. |

| Payments/Calculations and Floating Amounts | April 14, 2020 | Changes to terms relating to payments/calculations and floating amounts (note there have been no changes to the fixed amounts), including formulae, interpolation and other concepts associated with calculating payments due. |

| Miscellaneous | April 21, 2020 | Minor updates to various miscellaneous concepts, including options, cleared settlement and mark-to-market swaps. |

| Cash Settlement (including APAC WG) | May 6, 2020 | Changes to the cash settlement provisions for use in connection with optional early termination, mandatory early termination and swaptions. |

| Focus on APAC | May 27, 2020 | Unscheduled Holiday, Hong Kong Typhoon and Black Rainstorm Days and potential Deliverable Currency FX provisions. |

| Feedback on Calculation Agent / Dispute Resolution | June 16, 2020 | Discussion of the Request for Feedback on the Calculation Agent/Dispute Resolution provisions and initial working group responses. |

| Feedback on Calculation Agent / Dispute Resolution | June 23, 2020 | Second discussion of the Request for Feedback on the Calculation Agent/Dispute Resolution provisions and initial working group responses. |

| Follow Up Feedback on Calculation Agent / Dispute Resolution | July 7, 2020 | Discussion of the Follow Up Request for Feedback on the Calculation Agent/Dispute Resolution provisions. |

| Summary of Proposal for Calculation Agent Provisions | July 21, 2020 | Summary of the proposed changes to the calculation agent provisions reflecting the conclusions drawn from previous working group discussions and responses to feedback requests. |

| Feedback on Dates / Periods | July 28, 2020 | Further discussion of the Request for Feedback on the proposed changes to terms relating to dates and periods, including Business Days, Payment Dates and Period End Dates. |

| Feedback on Dates / Periods | August 6, 2020 | Further discussion of the Request for Feedback on the proposed changes to terms relating to dates and periods, including Business Days, Payment Dates and Period End Dates. |

| Feedback on Dates / Periods | September 3, 2020 | Summary of the proposed changes to the terms relating to dates and periods, including Business Days, Payment Dates and Period End Dates reflecting the conclusions drawn from previous working group discussions and responses to feedback requests. |

| Feedback on Deliverable Currency Disruption Events and Update on Publication Timing | September 29, 2020 | Discussion of the Request for Feedback on the Deliverable Currency Disruption Events provisions and an update on publication timing. |

| Implementation Plan and Timeline | October 27, 2020 | Discussion of the updated implementation plan and timeline working towards May 17, 2021 for publication and June 21, 2021 for adoption of the new definitions. |

| Cash Settlement Feedback Request | November 3, 2020 | Discussion of the Request for Feedback on the Cash Settlement provisions, including member questions. |

| Cash Settlement Feedback | November 19, 2020 | Discussion of the feedback received on the Request for Feedback relating to the Cash Settlement provisions. |

| Cash Settlement Feedback | November 24, 2020 | Further discussion of the feedback received on the Request for Feedback relating to the Cash Settlement provisions. |

| Cash Settlement Feedback | December 1, 2020 | Continuation of the discussion of the feedback received on the Request for Feedback relating to the Cash Settlement provisions. |

| Cash Settlement Feedback | December 8, 2020 | Continuation of discussions relating to feedback on the cash settlement provisions. |

| Cash Settlement Feedback | December 15, 2020 | Continuation of discussions relating to feedback on the cash settlement provisions. |

| Cash Settlement Feedback | December 17, 2020 | Continuation of discussions relating to feedback on the cash settlement provisions, including coverage of the most recently circulated additional feedback request. |

| APAC Update | January 12, 2021 | Update to APAC members on the implementation timeline, User Interface, cash settlement provisions/feedback and proposal for FROs. |

| Implementation Update and Cash Settlement Reference Banks Proposal | January 12, 2021 | Update on the implementation timeline, including certain milestones and a recap on the proposal for Cash Settlement Reference Banks. |

| FRO Matrix | January 21, 2021 | Discussion of the Floating Rate Option Matrix and proposed naming convention. |

| Generic Fallbacks | January 26, 2021 | Discussion of the proposal to introduce generic temporary and permanent cessation fallbacks for benchmarks not covered by the IBOR Fallbacks Supplement. |

| Generic Fallbacks | February 2, 2021 | Continued discussion of the proposal to introduce generic temporary and permanent cessation fallbacks for benchmarks not covered by the IBOR Fallbacks Supplement, focusing on the FRO Matrix and certain features of a benchmark. |

| Floating Amounts (Section 6) | February 9, 2021 | A work through of Section 6 – Floating Amounts and an update on implementation timeline. |

| Floating Amounts (Section 6) | February 16, 2021 | Continued work through of Section 6 – Floating Amounts. |

| Implementation and FR Matrix | March 9, 2021 | Discussion of the Implementation Timeline, FR Matrix, Day Count Fractions, Temporary Non-Publication triggers and fallbacks and Permanent Cessation Fallbacks for Swap Rates. |

| Main Book | March 16, 2021 | Discussion of miscellaneous outstanding points from the Main Book including the definition of Close of Business, Determinations by the Calculation Agent, Modified Preceding Business Day, Unscheduled Holidays, FRA Yield Discounting, Mark-to-Market Matrix, In-the-Money/Out-of-the-Money/Settlement Rate Fallbacks and Settlement Rate on Automatic Exercise. |

| Main Book | March 23, 2021 | Continuation of discussion of miscellaneous outstanding points from the Main Book including Settlement Rate Fallbacks, Settlement Rate on Automatic Exercise and the Settlement Matrix. |

| Section 6 (Floating Amounts) Section 7 (Fallbacks) FR Matrix |

March 23, 2021 | Walk through of the proposed approaches taken in light of responses to a variety of questions put to members relating to Section 6 (Floating Amounts), Section 7 (Fallbacks) and the FR Matrix |

| Implementation timeline update and Section 8 (Bespoke Triggers and Fallbacks) |

April 6, 2021 | Announcement of 4th October 2021 as the implementation date and walk through of Section 8 (Bespoke Triggers and Fallbacks, including the IBOR Fallbacks) |

| Fatal flaw, pre-publication and ongoing work towards verification of the FRO Matrix | May 4, 2021 | Discussion of the fatal flaw and pre-publication phases, what to expect over the coming weeks and a walk through of the work to be done in populating and verifying the FRO Matrix. |

| FRO Matrix | May 11, 2021 | Discussion of the draft FRO Matrix, including the outstanding list of questions requiring member feedback and a summary of certain proposed approaches that will be adopted absent contrary feedback. |

| APAC Q&A Session | May 27, 2021 | Q&A session to discuss issues relating to the implementation of the 2021 ISDA Definitions. |

Latest

Updated OTC Derivatives Compliance Calendar

ISDA has updated its global calendar of compliance deadlines and regulatory dates for the over-the-counter (OTC) derivatives space.

A Positive Step to Improve the FRTB in the EU

As the Basel III capital reforms are finalized for implementation in key jurisdictions, ISDA is maintaining a laser focus on making sure the rules are robust and risk-appropriate. Simply put, if capital requirements are set disproportionately high, this will have...

Trading Book Capital: Scott O'Malia Remarks

Trading Book Capital: Policy Challenges for the EU 2024-2029 Mandate March 25, 2025 Welcoming Remarks Scott O’Malia ISDA Chief Executive Officer Good morning and welcome to ISDA’s trading book capital event. It’s great to be here in Brussels and...

Setting Out the Value Proposition of Derivatives

History enthusiasts may have heard of the Code of Hammurabi, an early legal text from ancient Mesopotamia, carved into a stone slab about 3,700 years ago. The code covers everything from property rights to divorce, but it also recognizes the...